This insightful article from Financial Time’s Fund Fire Letter quotes PBHFA’s Founder and lays out the massive growth in South Florida—

By Lydia Tomkiw June 29, 2022

Florida is cementing itself as a major hub for the hedge fund industry following the announcement last week that Ken Griffin’s $51 billion Citadel – and its market-making business Citadel Securities – are moving their headquarters out of Chicago and down to Miami.

While Citadel’s move will be a multi-year process, hedge fund industry insiders expect more firms will follow with similar relocations, deepening the industry’s roots in the state.

As part of the move, Citadel is planning to build a new office on Brickell Bay in Miami’s financial district. While Citadel will keep a Chicago presence, Griffin has made clear his desire to relocate. For months, he has been a vocal critic of the city’s political leadership and crime rate, while saying that many of his teams are asking to relocate to Miami, as reported.

“[Citadel’s move] is extremely major,” said James Koutoulas, founder and CEO of Typhon Capital Management, a multi-strategy fund based in Miami Beach with $250 million in assets under management. “[It’s] the nail in the coffin for anyone who wants to delegitimize Miami… The Wall Street South thing is real.”

Koutoulas said he has been fielding calls for several years now about the market and helping people in finance make the move to Florida. “I think we will be number one in not too long. Give it five years,” he said.

Citadel’s move is a “homerun” for South Florida and will lead to other funds following, said David Goodboy, founder of the Palm Beach Hedge Fund Association, which has seen its membership grow the last several years.

“Whenever we have a big fund like that come here, there are a dozen or more small funds that get inspired by the move,” he said.

At least for the time being, the number one hedge fund market still bookends the New Haven line from Grand Central Station in New York City up to Greenwich and Stamford, Connecticut, said Erik Gordon, a professor at the University of Michigan’s Ross School of Business. But Griffin’s move has legitimized Florida on a different level, Gordon argued.

“I think this Citadel move, more than any of the announcements prior, changes the perception of Miami,” he said. “Miami is starting to look like the number two center for hedge funds. I don’t think Citadel will be the last one to go. The critical mass thing is important.”

The lure of a warm climate and no personal income tax have pushed many businesses to Florida in recent years.

Some of the industry’s largest hedge funds now have offices or headquarters based in Florida. Balyasny Asset Management, ExodusPoint Capital Management, Millennium Management, Point 72 Asset Management, D1 Capital Partners and Schonfeld Strategic Advisors have all expanded in the state. In 2020, Elliott Management moved its headquarters to Florida. In a recent move, hedge fund Aurelius Capital Management moved its headquarters to South Florida from New York, Bloomberg reported.

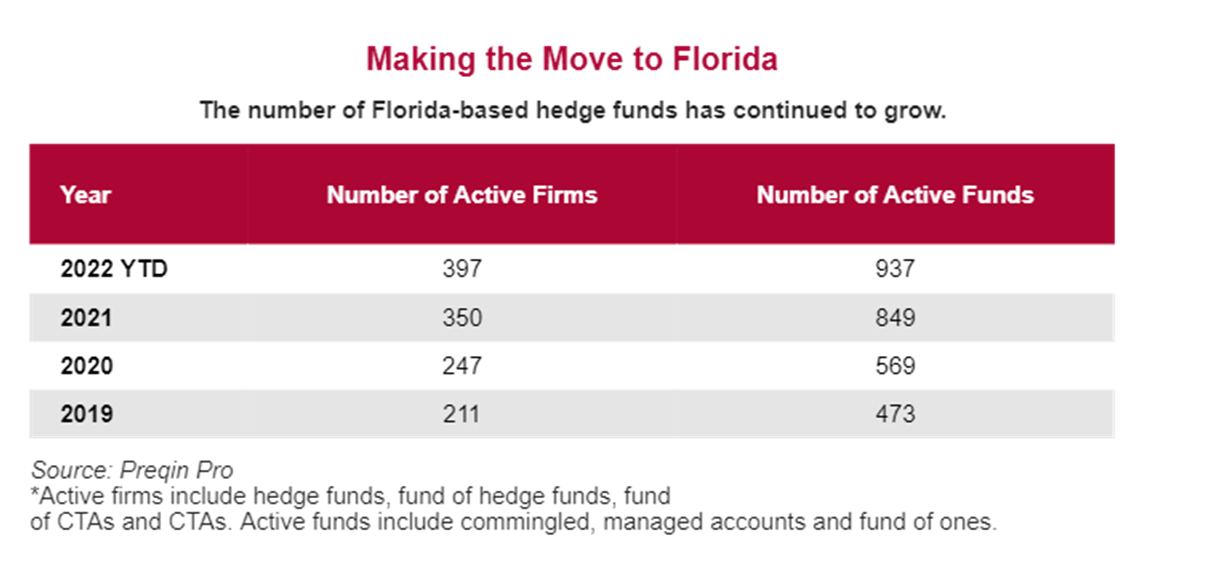

The number of Florida-based hedge funds has been steadily increasing over the past several years. There were 211 active hedge funds in Florida in 2019 and that number has now hit nearly 400 year-to-date, according to data from Preqin Pro.

Managers also are posting more hedge fund roles based in Florida, which has quickly made it a “top three” hedge fund destination, said Michael Goodman, managing partner at New York-based recruiting firm Long Ridge Partners. But while many senior members of firms want to be based in Florida, not everyone wants to be there, he added.

“There are people who want to be there and there are people who don’t,” he said. “A lot of firms have a footprint in Florida and a lot will continue to and a lot will migrate, but I think it will be an option, not one or the other.”

As the biggest funds all vie for talent, competing amongst each other, multiple office locations will become part of the standard offerings. “If you are a large fund, you have to have an alternative for people,” Goodman said.

Groups like the Miami-Dade Beacon Council also have been working to draw more financial services firms to the area and connect hedge funds to talent pools, including local universities and alumni groups, said James Kohnstamm, executive vice president for economic development at the council.

“The talent migration that happened during Covid proved our point: when given the opportunity, if those jobs were plentiful in our community, people would relocate for those opportunities – and we’ve been able to really show that,” he said.

More big funds moving to Florida will also lead to new funds launching, Goodboy said. “There are always spinoffs, portfolio managers start their own funds. It’s going to grow the financial ecosystem down here,” he said. “The growth that is going to come along with Citadel in all of south Florida – there is zero downside there’s only upside.”

And as far as Florida becoming the next hedge fund capital, Goodboy said he has no doubts.

“I absolutely think that soon this will be the new Chicago or Manhattan as far as hedge funds and money management firms are concerned,” he said. “I believe in the next couple of years this shift will become permanent.”

Related Content

June 24, 2022 Citadel Moves Hedge Fund, Securities HQs to Florida

August 25, 2021 Schonfeld Expands to Miami, Stamford and Plans Flex Work Format

August 04, 2021 Welcome to Miami: More Hedge Funds Grow Footprint in Florida

For more articles like this one, go to https://www.fundfire.com.FundFire is an information service of Money-Media, a Financial Times company. Please note that your email address will be stored to monitor compliance with our Terms & Conditions. In addition, if you work for a firm which has an existing license to FundFire, we may contact you with details on how to be added to the license at no additional cost. If you do not wish to be contacted for this purpose, please click hereto send an email request for removal.